The basic of Proof of Work

Ethereum is going to move from the Proof of Work (PoW) mechanism algorithm to Proof of Stake (PoS) in the upcoming months along with the implementation of ETH 2.0 upgrades, according to the Ethereum Foundation in April 2021. This announcement has raised a debate around these two protocol mechanisms. In this article, Tokenize will help acquaint you with the Proof of Work explained, the pros and cons of PoW, and the future of PoW.

What is Proof of Work?

PoW or Proof of Work is the consensus mechanism created in the Blockchain network to validate transactions. These transactions are recorded by distributed ledger technology (or blockchain) before confirmed and arranged in blocks according to chronological orders by miners (nodes).

The PoW algorithm is an essential part of the cryptocurrency mining process which requires a practical amount of effort to prevent malevolent uses of computer power such as cyberattacks.

Accordingly, Bitcoin was the pioneer for the use of PoW which forms the basis of many other cryptocurrencies such as Ethereum, Bitcoin Cash, Monero, Dash, and Zcash.

How does PoW work?

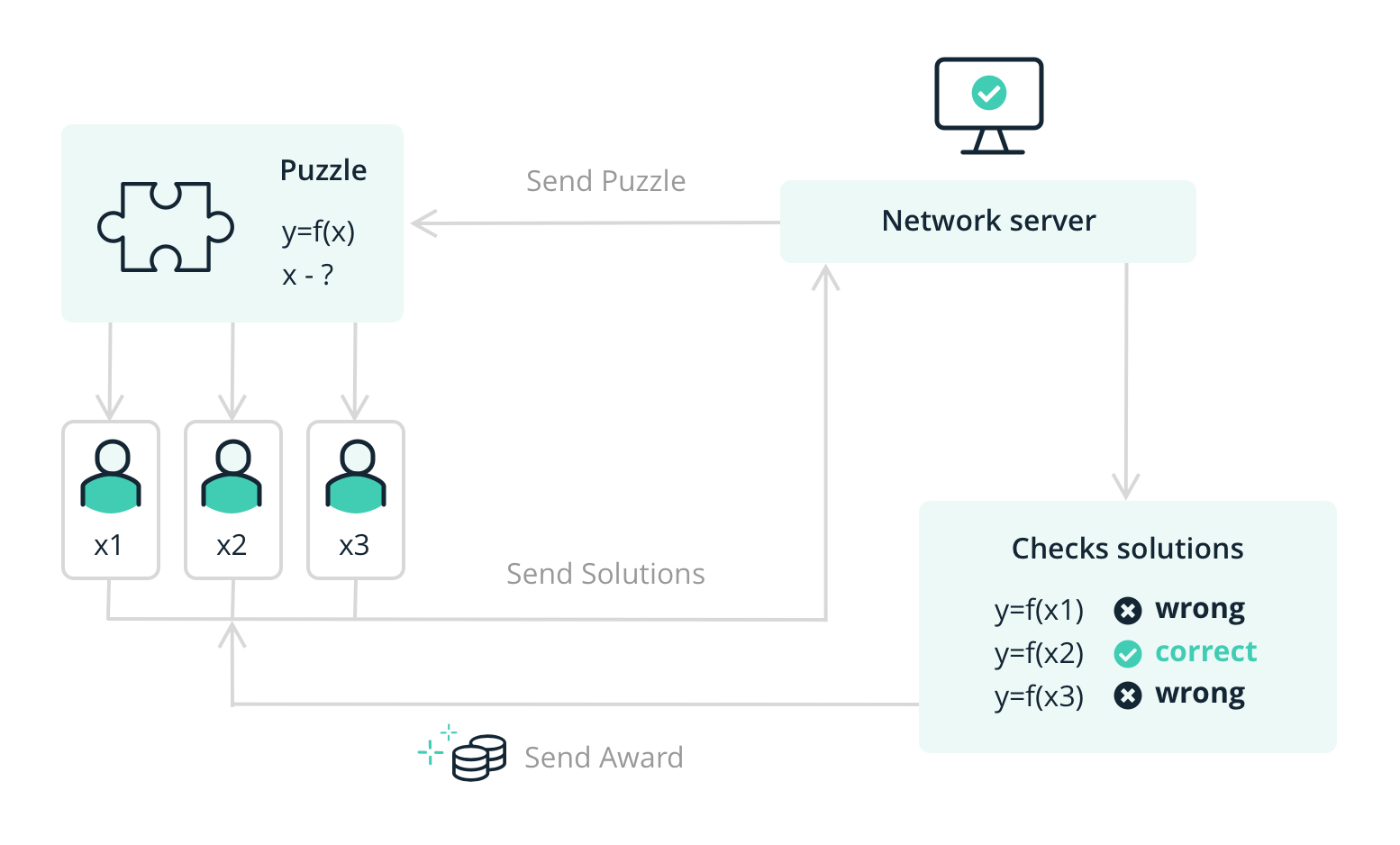

During the mining process, PoW requires the miners to solve complex math equation problems in order to add a new block to the chain and earn cryptocurrencies as rewards.

In the Bitcoin network, it would be a race for miners to be the first ones to solve the math computational puzzle to earn minted Bitcoin. The winning miner also gets a share of the transaction fees created by the network. Whenever a miner brings forward a new winning proof of work, a new block appears in the network.

Check out this infographic from ledger.com

Proof of Work explained

The purpose of Proof of Work

The advantage of PoW consensus mechanisms originates from its DoS attack defense and its mining possibility.

DoS attack defense

PoW forces some boundaries on the action in the blockchain network. Basically, it requires a great amount of computational power, time, and effort to successfully attack the system. Thus, the possibility of being attacked is quite low due to the high cost.

Mining possibility

Proof of work focuses on the computational power of miners to solve the mathematics equation instead of their assets in their wallets. Hence, billionaire holders are not able to manipulate the mining process and the entire blockchain network.

The disadvantages of Proof of work

Despite its benefit in a cryptocurrency network, Proof-of-work contains some problems:

High energy consumption

According to the Cambridge Bitcoin Power Consumption Index (CBECI), the total Bitcoin mining energy consumption, this year could reach tWH 144.28. This represents 0.6% of the world’s total electricity production and is similar to small countries like Norway, Sweden, and Malaysia, though it is powered by renewable energy sources.

Bitcoin mining has raised environmental concerns

Elon Musk – Tesla CEO has been known as one of the biggest supporters of digital coins who helped rally the prices of cryptocurrencies, including bitcoin, several times in the past year. It was revealed Tesla bought $1.5 billion worth of bitcoin. On May 13th, however, he claimed that Tesla will not accept Bitcoin as a payment method due to its increasing use of fossil fuels in Bitcoin mining and transactions.

Security vulnerabilities

51% attack refers to a mining entity or a group of attackers gaining control of 51% or more of the hash rate and computing power. Attackers can solve the problems faster than other miners, reverse old transactions, double-spend the coins, and manipulate the awaiting confirmation.

There’s no certain possibility that Bitcoin Blockchain can be manipulated by a group of attackers, however, some smaller PoW blockchains remain vulnerable to 51% attack. In fact, the 51% attacks on Ethereum Classic in August 2020 raised doubts about the Proof-of-work blockchain’s security protection.

Check out Crypto51 to learn the theoretical cost of a 51% attack on each Proof-of-work blockchain network. It indicates that the more mining power being used in secure Bitcoin, the more resources attackers need to successfully attack Bitcoin.

What is the future for Proof-of-Work?

It is undeniable that PoW has been the best mining tool available, it has become more and more expensive to generate. As more blocks are added to the existing blockchain, the process of solving mathematical puzzles for the next blocks is getting more challenging, leading to more complex hardware to handle the problems. Subsequently, the mining cost is exponentially rising.

Said Charles Allen, CEO of BTCS, one of the first blockchain-focused entrepreneurs “PoW mining requires the purchase of specialized computers that depreciate rapidly in value as they are typically run very hard in less-than-ideal conditions,” he added, “With the dozens of public companies now plowing into bitcoin mining, it is very difficult to ascertain if there is a high, or even a positive, business case because the actual return on investment is extremely opaque.”

Moreover, the environmental concerns related to Bitcoin mining energy have raised a public controversy about how to make Bitcoin mining more energy sustainable in the long run. Some blockchain networks like Ethereum initially based on Proof of Work are going to migrate to an alternative like Proof of Stake upon its coming upgrade: EIP 1559.

What’s the future for Proof of Work

In conclusion, it would be a good chance to observe if the consensus mechanism will experience radical changes with the Proof of Work alternatives or users will abandon it. See you in the next article at Tokenize Blog!

Subscribe to Tokenize Blog

Get updated with our guides, tips, and market news to help you in your investment.

Follow Tokenize Exchange on Facebook, Telegram, Medium, Twitter, Instagram.

Disclaimer

Cryptocurrencies are subjected to high market risk and volatility despite high growth potential. Users are strongly advised to do their research and invest at their own risk.